Why Brokers Have Winnipeg’s Best Mortgages

There is a lot of confusion between what a mortgage broker in Winnipeg does versus going to the traditional big banks. Essentially, we offer the same service, but as a mortgage broker, I have the ability to shop around to get you the best rate. I help find the best rate even if it happens to be from a bank. I negotiate on your behalf with dozens and dozens of lenders to help get you the best rate.

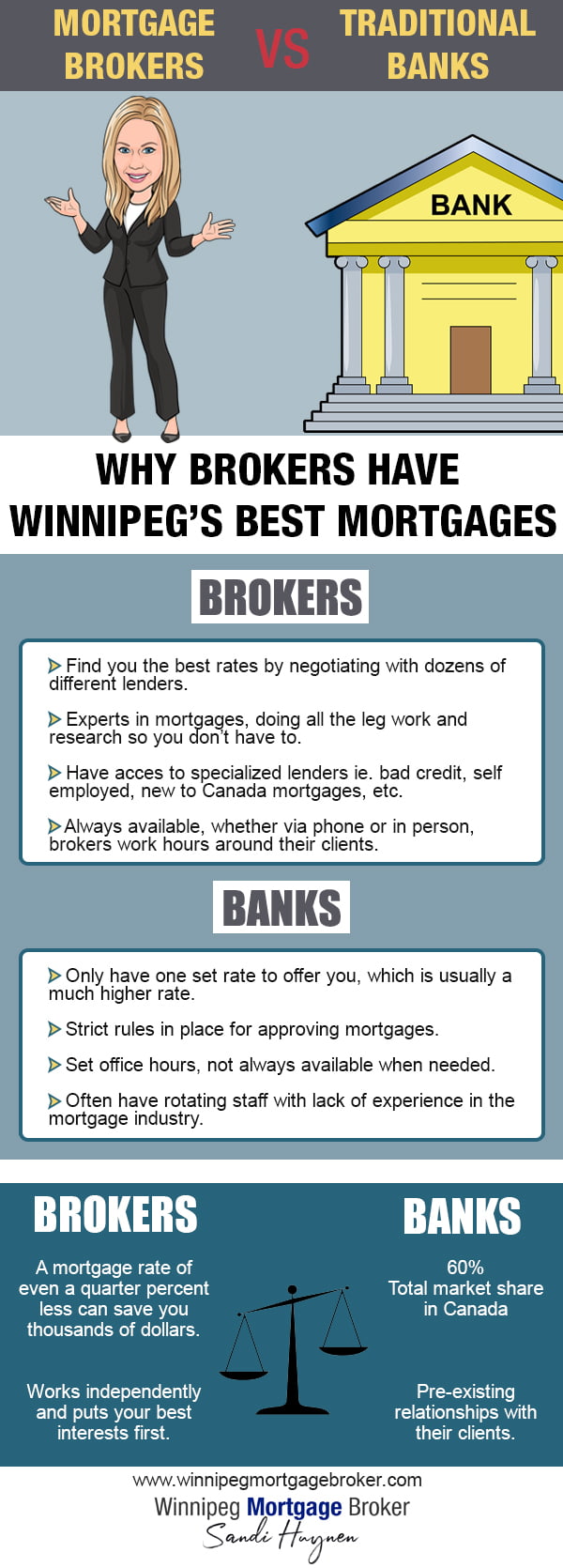

Infographic text:

Brokers

- Find you the best rates by negotiating with dozens of different lenders.

- Experts in mortgages, doing all the leg work and research so you don’t have to.

- Have access to specialized lenders ie. bad credit, self employed, new to Canada mortgages, etc.

Banks

- Only have one set rate to offer you, which is usually a much higher rate.

- Strict rules in place for approving mortgages.

- Set office hours, not always available when needed.

- Often have rotation staff with lack of experience in the mortgage industry.

Brokers

A mortgage rate of even a quarter percent less can save you thousands of dollars.

Works independently and puts your best interests first.

Examples of lenders used in Winnipeg: First National, Home Trust, RMG Mortgages, Street Capital, MCAP, Merix.

Banks

60% Total market share in Canada

Pre-existing relationships with their clients.

Examples of big traditional banks in Winnipeg: RBC, TD Bank, Scotia Bank, CIBC, Bank of Montreal, HSBC.